You can pay for EPF Self Contribution via cash bank draft cheque and online banking through the following channels. You can use EPF balance to repay your home loan EMI either fully or partly as per your wish.

Payroll Panda Sdn Bhd How Do I Pay Epf

Different from the normal EPF SOCSO and EIS standard table rate the calculation of MTD can be a bit complicated.

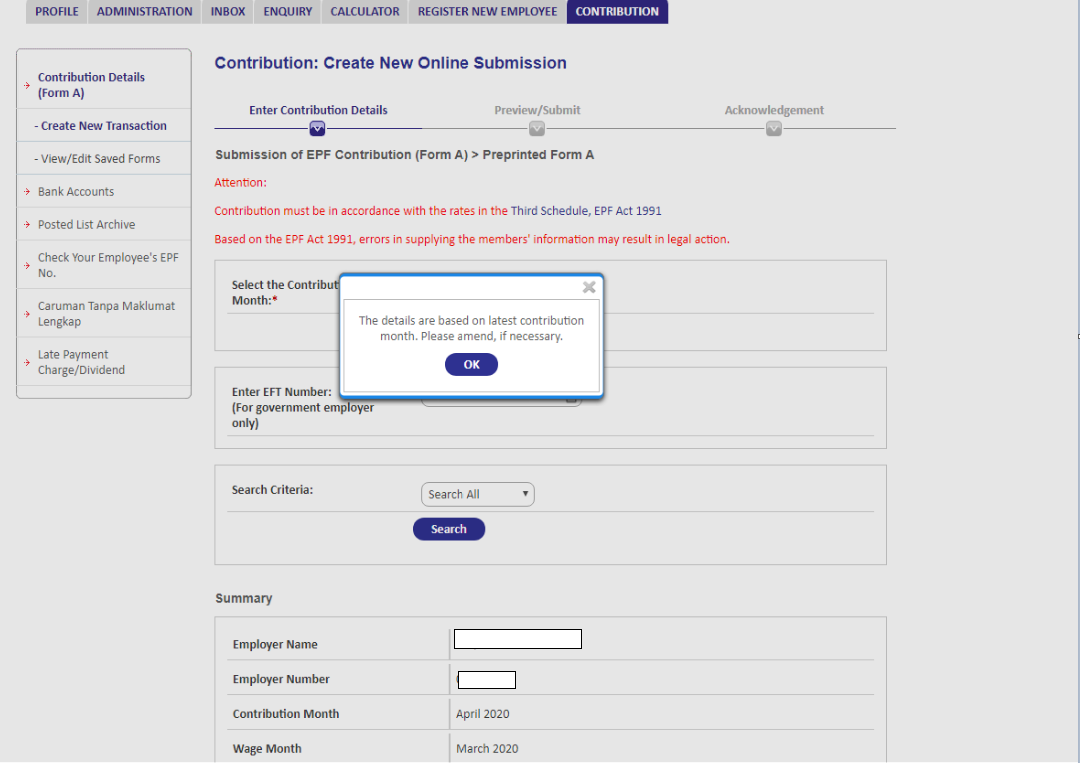

. In case of death of the employee the accumulated EPF fund amount is transferred to the nominee to help the family in difficult times. Go to i-Akaun Majikan dan click on i-Akaun Activation First Time Login. EPF Form 31 can be filled online as well as offline.

EPFO will transfer the money to your bank monthly as long as there is sufficient EPF balance in your account. It also shows the example calculation to ensure employers calculate the. Individual as well as Corporate customers of the bank can pay their Direct Taxes conveniently through the e-pay tax tab using Net Banking or by.

EPF members can call the EPF toll free help desk number 1800118005. The bank account details have to be digitally approved by the employer. This transfer will be active as long as you are the member of EPF.

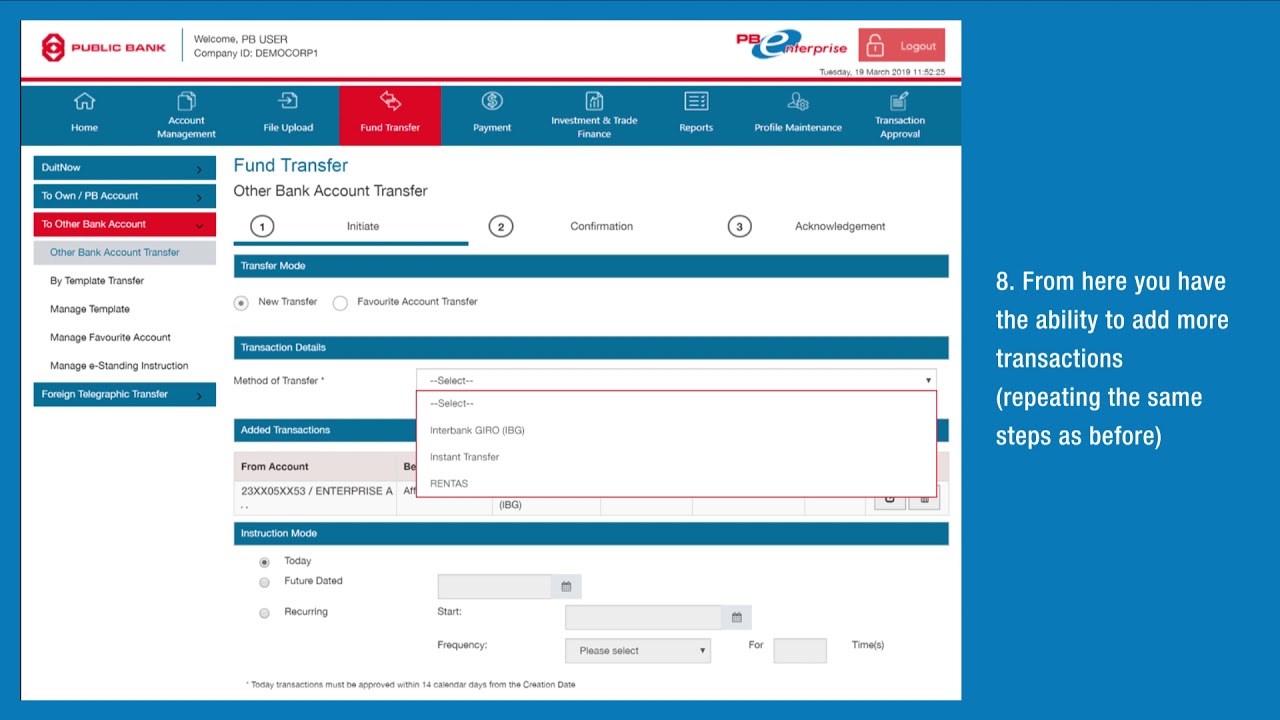

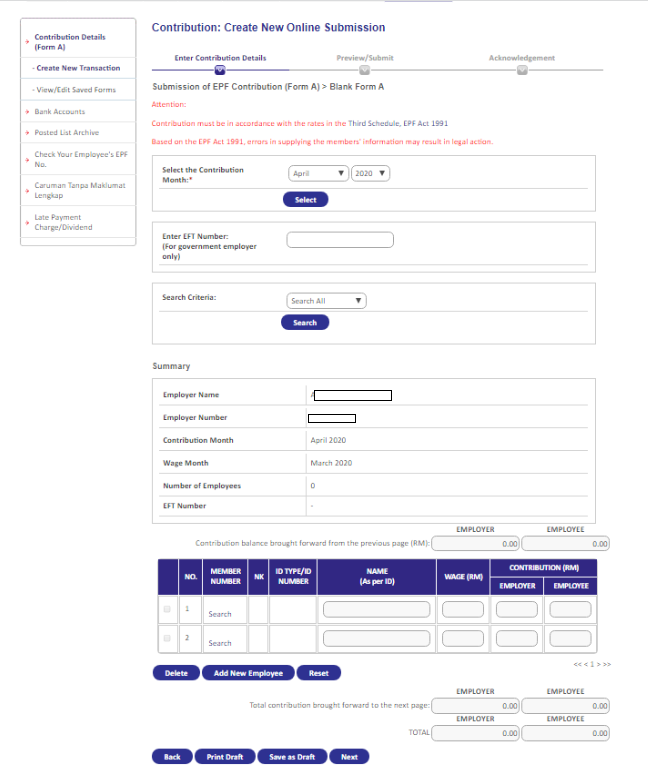

As for Public Bank online the step-by-step. EPF Form 31 is used to make declaration for partial. These two banks are now taking tax payments in both Over the Counter and Net Banking forms.

How to pay EPF Self Contribution through Public Bank online. How to Check EPF Balance of Exempted EstablishmentsPrivate Trusts. EPF Interest rates are reviewed and recognised every year by the EPFO Central Board of Trustees.

If you hold an active account with our panel bank and your identification number matches the bank records. In between these timings EPF members can call to this number. Federal Bank Individuals can now pay their taxes instantaneously using any of their available payment methods including debitcredit cards UPI net banking cash NEFTRTGS and so forth according to a press release issued by the bank.

Employers who have registered a mobile phone number for TAC may make updates via i-Akaun or any EPF counter by filling in Form KWSP 1i. Terms for TAC activation. They can transfer their PF account whenever they change jobs.

Apart from the above said online method for EPF claim status check you can also check your EPF claim status through offline modes like a call. You need to call on. For that you have to instruct the EPFO.

The employee has to manually fill his details in the form while applying offline whereas if the employee applies online most of hisher details will be auto-filledHowever the member has to register his UAN to avail the online service. Full payment will be made via Foreign Demand Draft in the currency of your choice If your preferred currency is included in our list of approved currencies. Employer has registered i-Akaun.

In case of mis-match in KYC details and details in EPF account please submit online request for demographic detail correction through your employer. Hence LHDN has assisted in furnishing the specification for MTD calculations using computerized calculation for year 2021. You can make cash payments maximum RM500 or cheque payments at EPF counters nationwide.

Hate Paying Taxes Check How to Pay 0 Income Tax on Salary of Rs 20 Lakh FY 2021-22 Read More Income Tax Calculator for FY 2020-21 AY 2021-22 Excel Download Calculators Budget Budget 2020 Income tax Investment Plan Tax Return Taxes. Interest on EPF Balance. Declaration in Form 31.

The toll free EPF claim status contact number is 011-22901406. This number works in between morning 915 Am to the evening at 545 Pm. You will be issued a Bankers Cheque If payment to your account is unsuccessful.

When total contribution to NPS superannuation fund and EPF account by your employer exceeds Rs 75 lakh in a financial year Case II. After the recent consultation with the Ministry of Finance the interest rate for the financial year 2021-22 is 810. The Universal Account NumberUAN provides easy access to the employees to their PF account via the EPF member portal.

This is the easiest and one of the primary methods to contact EPFO whenever you have a problem or queries regarding PF. When contribution to EPF account exceeds Rs 75 lakh in a financial year and no contribution is made to NPS and superannuation fund Suppose an employee does not have an NPS account and superannuation fund. Employers can register their mobile numbers via i-Akaun or at any EPF counter.

It is available via this link.

Payroll Panda Sdn Bhd How Do I Pay Epf

How To Perform Fund Transfer Youtube

Payroll Panda Sdn Bhd How Do I Pay Epf

.aspx?maxsidesize=1024)

Public Bank Berhad Epf Contribution

How To Pay Epf I Saraan Online Using Public Bank The Money Magnet

How To Pay Epf I Saraan Online Using Public Bank The Money Magnet

Payroll Panda Sdn Bhd How Do I Pay Epf

Payroll Panda Sdn Bhd How Do I Pay Epf

Want To Take Loan Against Ppf Account Know Conditions For Taking Loan Eligibility And More Finance Bank Retirement Fund Public Provident Fund

Pb Enterprise Statutory Payment Epf Youtube

How To Pay Epf I Saraan Online Using Public Bank The Money Magnet

How To Pay Epf I Saraan Online Using Public Bank The Money Magnet

How To Pay Epf I Saraan Online Using Public Bank The Money Magnet

Payroll Panda Sdn Bhd How Do I Pay Epf

How To Pay Epf I Saraan Online Using Public Bank The Money Magnet

Today We Will Discuss About Current Scenario Of Indian Banking System And Best Bank Of India Best Bank Bank Of India Bank Of Baroda

How To Pay Epf I Saraan Online Using Public Bank The Money Magnet